National Bureau of Economic Research (NBER) has developed a model that calculates the budget revenues at different fuel prices. Unfortunately, I haven’t found the original research on www.nber.org website (if anyone could give the link in the comments I would be very grateful). The model calculates the economic condition of not only Russia but also the United States, India, the EU, Japan and Korea.

The results obtained suggest the following.

By 2084, fossil fuel reserves will be exhausted (the RF Ministry of Natural Resources agrees with that as well), tax rates around the world will increase dramatically. Due to serious dependence of our budget on tax revenues from the oil and gas sector, Russia is assumed to have the highest rates growth.

The model also forecasts which measures of economic policy can most efficiently reduce the negative effects in our country. According to experts’ opinion, those measures include:

-

transition to personalized pension accounts (What might that mean? - author's note);

-

abolition of corporate income tax;

-

an increase in the birth rate by 25% (The measure is understandable, but when you think about the implementation methods, a famous anecdote about the owl and strategy comes to mind - author's note)

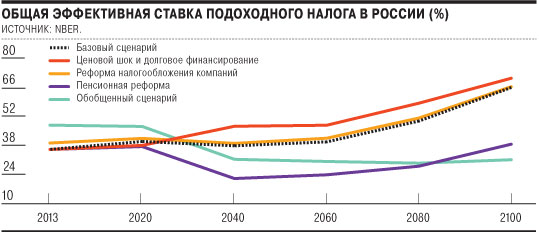

As a result, according to the baseline scenarios the effective tax rate on personal income were calculated.

As can be seen from the graph, the personal income tax rate can range from 30 to 70%. Please note that this is an effective rate rather than the nominal rate. As at such a rate will be motivated to work, is not clear. However, researchers recommend to abolish corporate income tax, it could encourage investment.

In general, We will have quite boring reality, where there will be no mining tax and other resource taxes, no income taxes. And the memories and stories about that, what was once upon a time there was a wonderful personal income tax rate of 13%, will be more like the legends and myths.

On the other hand, the authors clearly hope that humanity will not ruin yourself up in 2084. This is a big plus.

Dmitri Kostalgin

Dmitri Kostalgin